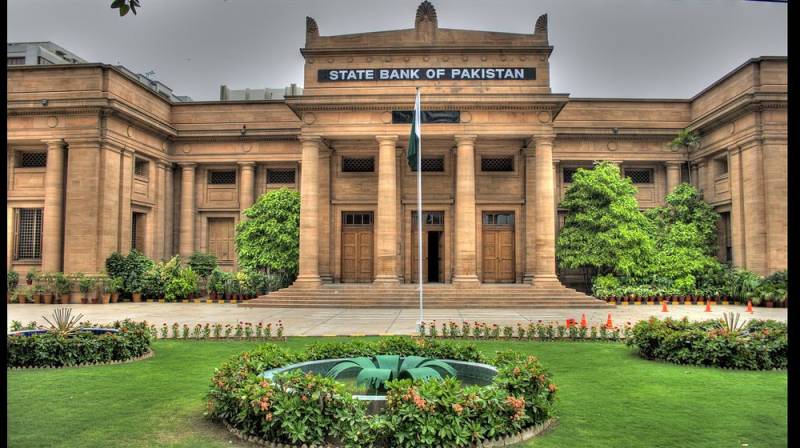

State Bank of Pakistan imposed heavy penalties on 4 top Pakistani commercial banks

Shares

ISLAMABAD - State Bank of Pakistan (SBP) has imposed heavy penalties on four commercial banks in November 2019 due to the violation of various rules and regulations related to operations and services.

SBP’s enforcement order states that MCB Bank, Habib Bank Limited, Allied Bank Limited and Bank of Punjab were inspected by the central bank’s team which led to the imposition of penalties on these banks. MCB Bank

MCB Bank has been penalized with a penalty of Rs. 91.85 million for violating Customer Due Diligence/Know Your Customer (CDD/KYC) regulations.

In addition to penal action, the bank has been advised to conduct an internal inquiry on certain breaches/violation of regulatory requirements.

The bank has also been advised to strengthen its KYC/CDD processes to avoid such violations in the future. Allied Bank Limited

Allied Bank Limited (ABL) has been slapped with a penalty of Rs. 60.79 million in November for the violation of procedures under CDD/KYC, same as MCB Bank.

ABL has also been advised to conduct an internal inquiry on breaches of regulatory requirements and take disciplinary action against the officials responsible for the violations. Habib Bank Limited

Habib Bank has been fined Rs. 25.98 million in November 2019 for violating CDD/KYC procedures as well.

The bank has been given a timeline to improve its systems/controls to avoid the recurrence of these violations. Bank of Punjab

Bank of Punjab was caught again by the inspection team for violating the areas of CDD/KYC.

In addition to penal action, the bank has been advised to improve KYC/CDD.

The central bank has enforced stringent rules and regulations regarding Customer Due Diligence/Know Your Customer as this ultimately caused the notorious Benami accounts in the banking system.

Bankers usually provide services to their customers without completing the requisite procedures including submissions of the required documents on the assurance of later submissions. This practice is common as bankers are supposed to reach massive targets from their management.

The central bank should look into the matter and also trace the roots of the violations which have become frequent in the banking industry.

Overall, the central bank has imposed penalties of Rs. 1.34 billion in the five months since July 2019. Several banks were penalized multiple times.