Drastic cut in interest rates in Pakistan on cards

Shares

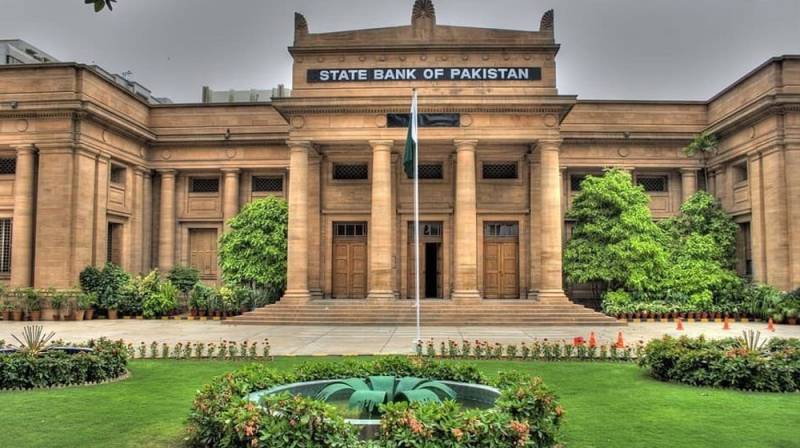

The country's interest rate is projected to decrease to 17 percent by May 2024, allowing the central bank to potentially reduce the policy rate to 19 percent by the end of the current fiscal year FY24, as per a report from Arif Habib Limited (AHL).

FY24 began with a high year-on-year (YoY) headline inflation, averaging 27.8 percent in Jul-Aug, and spiked to 31.4 percent in September 2023, primarily due to a low base effect and rising fuel costs. The second quarter is expected to maintain high headline inflation due to increased gas tariffs, elevated international oil prices, and moderate depreciation of the PKR, according to the report.

Inflation is anticipated to moderate in the third quarter, with both YoY and MoM rates showing a decreasing trend. YoY CPI is projected to gradually decline from 26.4 percent to 19.4 percent, indicating a slowdown in price increases compared to the previous year, mainly due to a high base effect.

The report suggests that with the expected decrease in inflation to 19 percent by March 2024, there is room for the central bank (SBP) to consider initiating a policy easing move, possibly announcing a 100bps reduction in March 2024. This would be the first rate cut since June 2020, after a gap of over 3.5 years.

Furthermore, the report anticipates a significant decrease in both YoY and MoM inflation rates in the fourth quarter. YoY rates are projected to drop further to 17 percent in May, providing additional leeway for the SBP to reduce policy rates, especially as real interest rates turn positive. The report expects the central bank to cut rates by 200bps in this quarter, ending FY24 at around the 19 percent level.