"Huawei Pay" puts Pakistan at the forefront of the digital payment system in the World

Shares

ISLAMABAD - The National Bank of Pakistan (NBP) has been aggressively working towards developing a digital product suite by leveraging disruptive technology in the banking industry and providing easy to use platforms to its customers to fulfill their financial needs.

NBP is one of the largest commercial banks of Pakistan, operating through more than 1500 local and international branches and has achieved a strategic milestone by becoming the first bank in Pakistan to launch ‘Huawei Pay’ for its mobile banking users with Huawei or Honor smartphones.

Pakistan has become the third country in the world accepting Huawei Pay transactions after China & Russia, putting Pakistan at the forefront of the digital banking transformation.

The milestone was achieved in collaboration with UnionPay International (UPI), NBP’s strategic partner and Paysys Labs, NBP’s technology partner. This initiative is important for NBP as it paves the way for building an echo system for digital payments as Huawei Pay enables NBP mobile banking users that own Huawei or Honor smartphones to enjoy QR & NFC Payments at UPI N-Tag & QR Merchants.

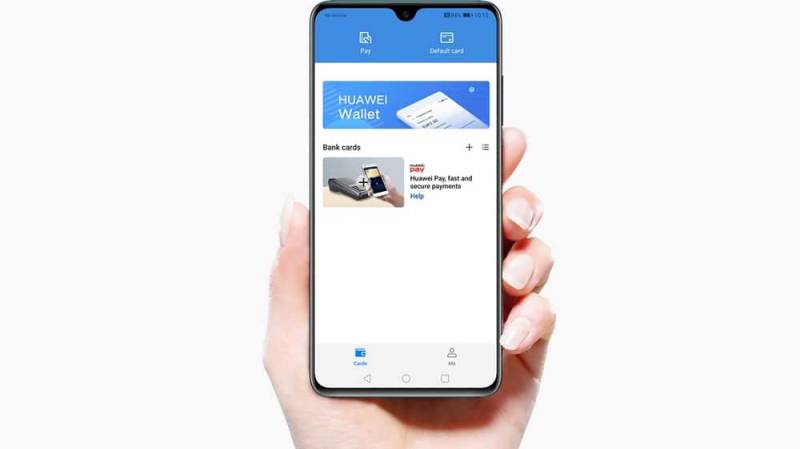

Through Huawei Pay, NBP UPI Virtual Card Holders will benefit from quicker and convenient digital payments, with fully secure technology. NBP UPI Virtual Card Holders can simply begin utilizing the service by adding their card details to the Huawei Pay Wallet App. The app also has an in-built feature of viewing purchase history for customers to keep a track record. Why is This a Paradigm Shift in Banking for Pakistan?

Over the years, merchant acquiring has been a major issue in Pakistan as there are only 57,000 POS devices placed at only 29,000 unique merchant locations in the country. Two key reasons behind this are the high cost of acquiring and inefficient settlements.

With the launch of Huawei Pay, a milestone has been reached whereby POS acquiring is no longer a limiting factor. With N-Tag & QR payments, merchants across the country with little or no acquiring cost can be onboarded with no connectivity link up required.

The easier to apply and plug & play methodology and with the rising number of tech-savvy consumers, particularly millennials and generation z, it will be comparatively easier to build an ecosystem for digital payments at zero startup cost.