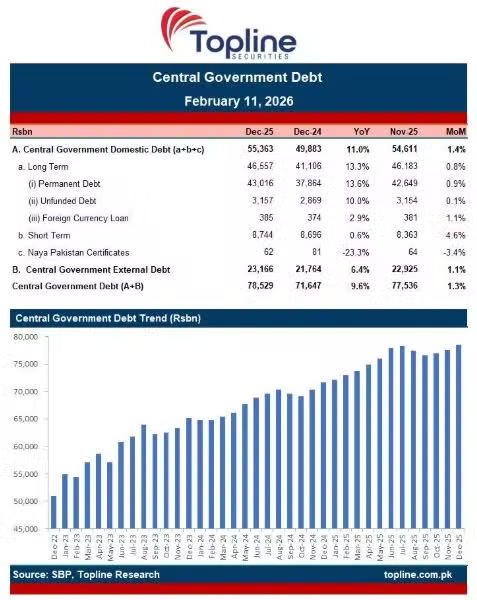

The receivables of the power sector have soared up to Rs. 1.437 trillion,up 4.5% from Rs. 1.375 trillion in the first two months of the currentfiscal year, Business Recorderlinkreportedon Thursday.

Receivables stock which grew to Rs. 479 billion during 2019-20, has posteda growth of Rs. 32 billion in July and Rs. 32 billion in August 2020.

This caused the stock of the federal government’s receivables to go up fromRs. 17 billion on June 30, 2020, to Rs. 21 billion.

– For AJ&K government it went from Rs. 145 billion to Rs. 152 billion – For FATA it went from Rs. 38 billion to Rs. 40 billion, – For Agri Balochistan, it went from Rs. 266 billion to Rs. 275 billion – For KE (Karachi Electric) it went from Rs. 169 billion to Rs. 180 billion – For provincial governments, it went from Rs. 71 billion to Rs. 78 billion – For private (Discos) it went from Rs. 664 billion to Rs. 688 billion – For Independent Power Producers (IPPs) it went to Rs. 4 billion.

On September 29, 2020, the recently replaced SAPM on Power Shahzad Qasimhad informed the cabinet that the government is likely to increaseelectricity tariff by Rs. 6.06 per unit in a bid to clear the backlog ofcircular debt in the financial year 2023.

He informed the cabinet that the circular debt base stood at Rs. 450billion in the financial year 2018, which went up to Rs. 850 billion in thefinancial year 2020. Power Division was of the opinion that it would riseto Rs. 1.6 trillion in the financial year 2023.

Qasim who was replaced with Tabish Gohar, a very close friend of Arif Naqviof Abraaj Capital which owns 66.4 percent shares in KE, said that it wouldmove from non-targeted to targeted subsidies in the power sector. Atpresent, all consumers using 300 units per month are given subsidies.

The government is conducting surveys to give targeted subsidy to deservingconsumers. It would also move interest costs from power tariff to publicdebt.